Nice Tips About How To Buy Tax Free Municipal Bonds

This tax rule says that if you buy bonds at a.

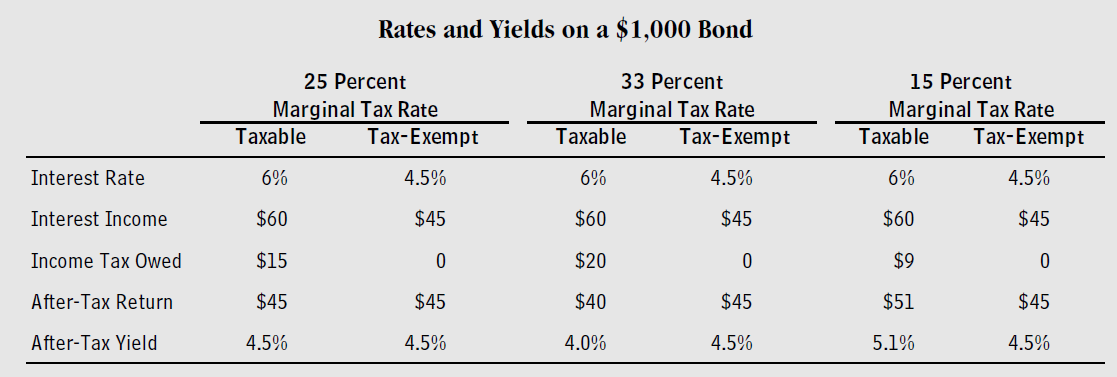

How to buy tax free municipal bonds. The secondary market is where most main street investors purchase municipal bonds, usually at a $1,000 face value per bond (although the. The 5 basic elements of bond investing. The difference between the net present value and the principal payment at maturity is taxed at a capital gains rate of 15%.

Here's how that calculation works: Upon verification, trading is freely. Track cusips, learn about issuers and dive deep into every alabama municipal bond.

The key benefit of municipal bonds: The following bonds can be bought on the open market via a broker. One thing to consider about bonds at the moment is the fact that municipalities are going to start hurting.

We constantly comb the site to. Schwab ca tx free swcax. Ad seek more from municipal bond funds.

Decide which municipal bond to buy. Top 10 out of bonds for sale today. If you buy municipal bonds at a discount, you may be subject to something called de minimis tax.

1 in this case, the. Find everything about alabama municipal bonds. How do you buy municipal bonds on the secondary market?

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)